INVOICE FACTORING

Convert outstanding invoices into immediate cash.

Receive up to 90% of the invoice value up front and the balance, less fees, when your customer makes the final payment. Factoring reduces your A/R administrative burden because we manage the sales ledger, send statements and make collections. This allows you invest your time building your client base instead of wasting time on paperwork and collections.

Non-notification

available

If you prefer, we can factor your invoices under your name without notifying your customers.

Spot factoring and contract factoring available

You can select the factoring arrangements that help you the most.

Factoring Process

Invoice your

customer

Provide your service and create an invoice for your client

Submit your invoice

Send your invoice to the factoring company

Receive funds

Receive up to 90% of the invoiced amount

Receive balance of funds

Once your client pays the invoice, the factoring company sends you the balance of the invoice, less fees.

Documents Needed

PURCHASE ORDER FINANCING

Turn the purchase orders you’ve received from your business customers into capital you can use to pay your suppliers and complete the order.

Provides up to 75% of the end customer sale price. Purchase Order Financing emphasizes the financial strength and creditworthiness of the company that has placed the order with you, and not on your business. This makes Purchase Order Financing an excellent option for startups and businesses with less than good credit.

We provide either Letters of Credit or cash to secure the inventory, raw materials and supplies you need to fill the order.

IMPORT-EXPORT FINANCING

AllFi Inc. Global Streamline your global supply chain!

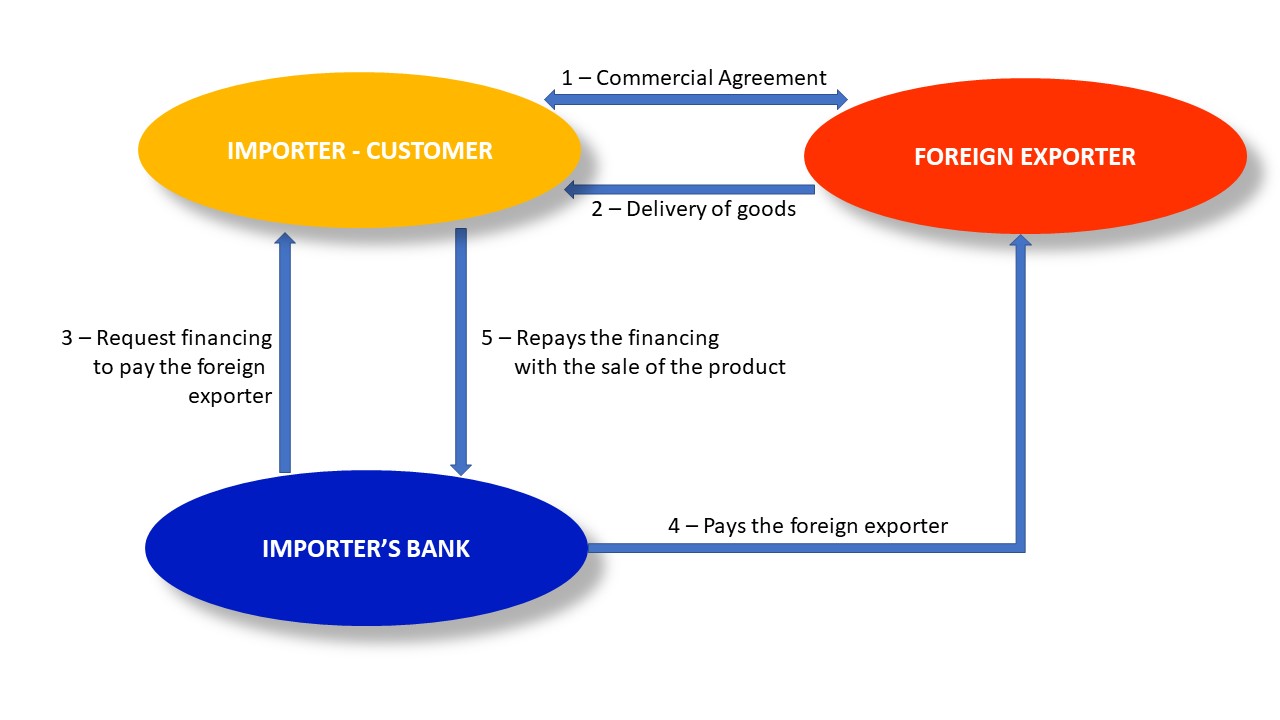

Import Financing

Use import financing to provide letters of credit guaranteeing payment to foreign supplier.

Financing Available As

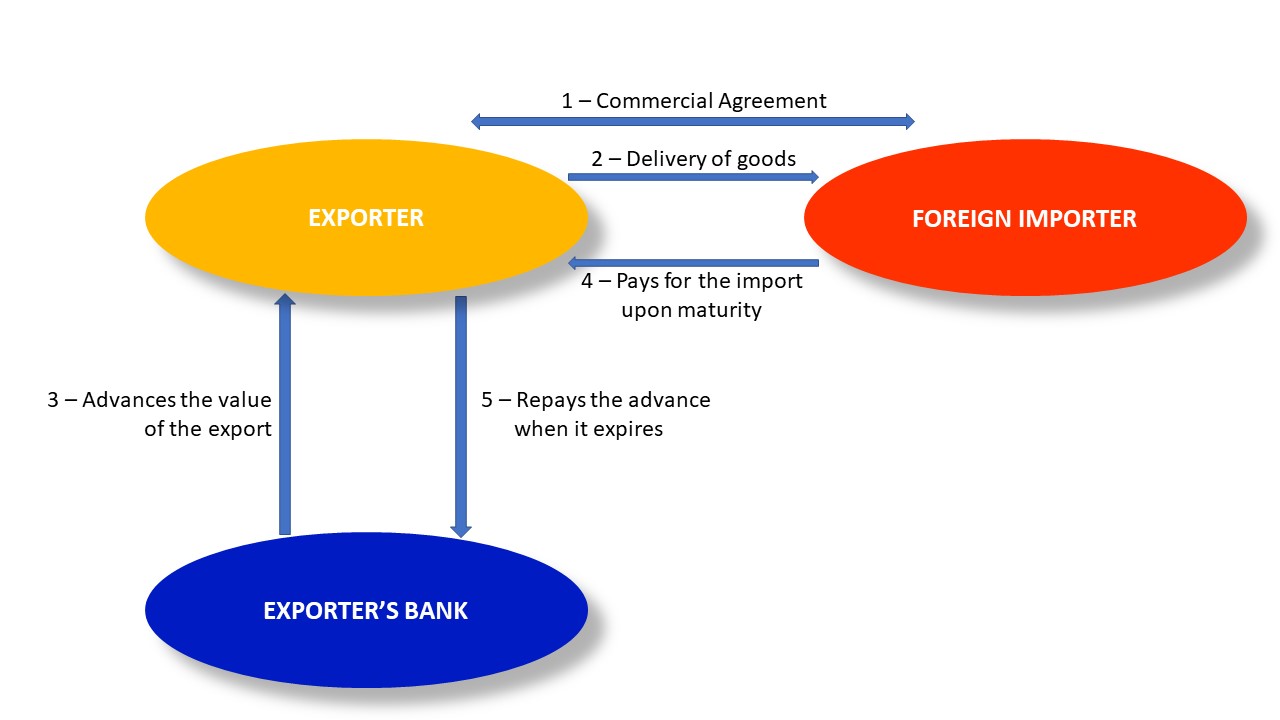

Export Financing

Get paid immediately upon delivery of goods. Full service management and collection of your receivables. Non Recourse and Recourse financing available.

Financing Available As